In accounting, what exactly do we mean when we talk about "Assets?"

In the context of accounting for finances, “Assets” are resources that are in the possession of the entity. It does not matter whether the asset in question is tangible or intangible; what matters is that it can be owned and assigned a value. as well as being owned by a company or organization that is capable of producing positive economic value. can say, without much difficulty, that assets represent values that can be turned into cash. (Despite the fact that cash is also regarded as an asset.)

The chart of accounts (COA) that is typically used includes the assets. The chart of accounts is broken down into five distinct sections, which are as follows:

- Asset category

- Debt category

- Owner’s equity category

- Income category

- Expense category

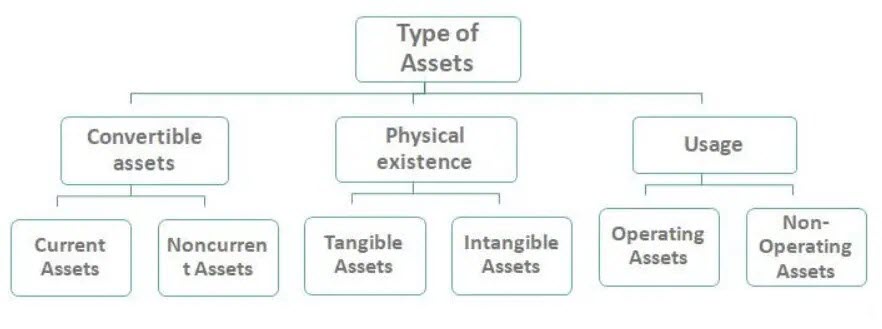

How many types of assets are there (Types of Assets) ?

Current Assets

Non-Current Assets

Intangible Assets

Current assets are cash assets. Or it can be converted to cash within 1 period of business or 1 year. In other words, assets that are easily and quickly converted to liquidity, such as cash, bank deposits or other assets. that can be quickly converted into cash such as inventories, bills of receipt, trade accounts receivable, etc.

Non-Current Assets are assets that cannot be exchanged for cash as quickly as possible. This type of assets will not be converted to cash within 12 months, such as land, buildings, machinery, etc.

What are non-current assets?

Land, Building and Equipment: (Property Plant and Equipment – PPE)

Long-term investments: (Non Current Investments)

Long-term receivables: (Non Current Receivables)

Intangible Assets means Accounting Standard No. 38 defines intangible assets as identifiable non-monetary assets. and has no physical characteristics The following conditions must be met: 1. Must be able to identify 2. Must be under the control of the business 3. Must bring economic benefits in the future 4. Measure costs reliably If any item does not meet the above conditions to be considered as expenses immediately except for transactions arising from a business combination Such items shall be treated as goodwill to be recognized at the date of purchase (FAP. under the Royal Patronage of His Majesty the King, 2020). Examples of intangible assets are

- Goodwill

Patents

Trademarks, brand names (trade names)

Leaseholds

Computer software

Copyright

Customer’s list

License

Relationship with customers or with the seller (customer relationship), etc.

Example Chart of Account (COA) Asset Category

1110000 Cash and cash equivalents

1110101 cash

1110102 Advance payment

1110200 Current bank deposits

1110300 Savings bank deposits, etc.

1120000 Accounts Receivable and Bills

1130000 Accrued income

1140000 Inventory

1140101 Finished goods

1140102 Products in process

1140103 Inventory

1150000 remaining material

1160000 short-term investment

1170000 Current Assets

1210000 Long Term Loans

1220000 Long-term investment

1230000 Land

1240000 buildings

1250000 Intangible assets

1260000 Non-Current Assets

Entrepreneur, Executive, Account Manager Anyone interested in Accounting and tax advisory services, business consult, Product destruction report preparation services and send the auditor Join as a witness to the destruction of the product or interested in having our company perform the product counting. Or check the stock (Ending Inventory), closing financial statements 2022, audit services, Audit Services, Financial Statement Audit. You can contact us via the channels below ;