Timeline Submit Financial Statements Year End 2024

Submission of financial statements for the year 2567, filing corporate tax for the year 2567 for business owners. According to accounting and tax laws in Thailand, the submission of financial statements for the closing of the 2023 fiscal year and corporate tax filing must adhere to the specified deadlines. Therefore, based on the provided example, […]

The importance of auditing

What is an accounting audit ? An accounting audit is a systematic examination and evaluation of a company’s financial records, transactions, processes, and internal controls conducted by a qualified and independent auditor or auditing firm. Its primary objective is to ensure the accuracy, fairness, and reliability of financial information presented in the company’s financial statements. […]

GL, AP, AR, and the importance of appropriate accounting system management

Managing an organization’s accounting system is critically important for effective business and financial management. In this article, we will explore and explain the most crucial components of the accounting system: General Ledger (GL), Accounts Payable (AP), and Accounts Receivable (AR). These are essential parts of an organization’s accounting system used to record and track financial […]

Apportionment of Purchase Tax

What is Apportionment of Purchase Tax ? The apportionment of purchase tax for business owners who are registered for Value Added Tax (VAT) and engage in both VAT and non-VAT activities, which involves purchase taxes incurred from acquiring goods or services used for their own business operations or for use in both VAT and non-VAT […]

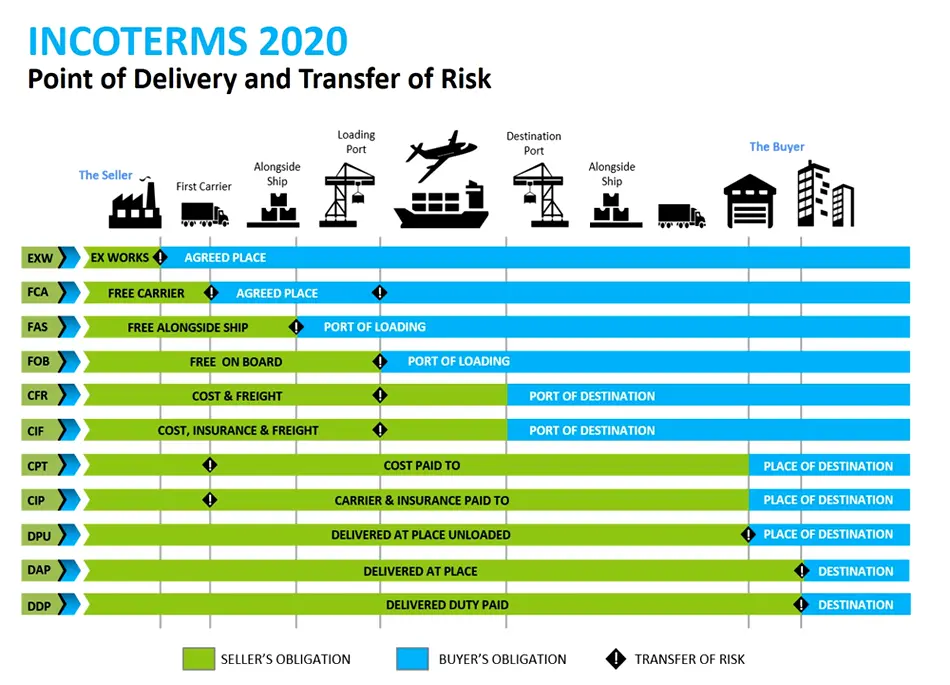

Incoterms (International Commercial Terms)

Currently, businesses in our country are providing opportunities for entrepreneurs to expand their markets to foreign countries. This is another avenue for increasing sales and promoting business growth. However, in conducting international business, it is essential for entrepreneurs to understand the conditions of delivery, as it directly impacts the cost of their business. Regarding the […]

VAT 0 VS Non VAT

Value Added Tax (VAT) Value Added Tax, or VAT, is a type of tax imposed by the revenue department, collected from the sale of goods or provision of services at each stage of production and distribution of goods/services, including those produced domestically and imported from abroad (according to the revenue code, the standard rate is […]

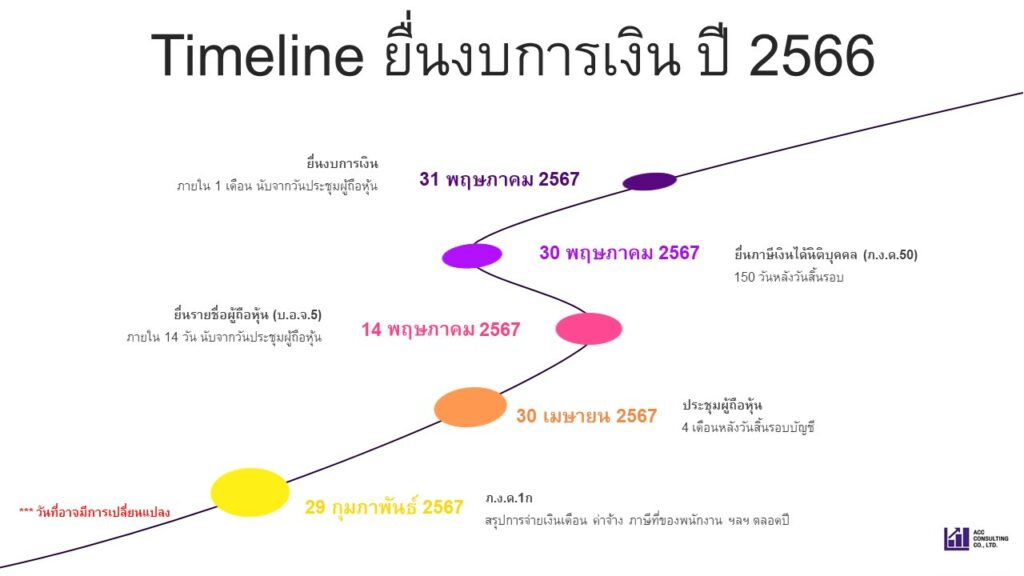

Timeline Submit Financial Statements Year End 2023

Filing financial statements for the year 2023 and submitting corporate tax returns for the year 2023 for business owners For business owners of a limited company with a fiscal year-end on December 31, 2023, the following deadlines apply for closing the financial statements for the year 2023, auditing the financial statements for the year 2023, […]

Closing Entries

“Closing Entries” refers to the process of transferring temporary accounts related to capital, such as withdrawals, revenue, and expenses, to the capital account in order to determine the accurate ending balance of the capital account at the end of an accounting period. This process also involves calculating the balances of asset and liability accounts and […]

The difference between TFRS PAEs and NPAEs standards

Before we delve into PAEs and NPAEs, let’s get acquainted with the financial reporting standards in Thailand. Thailand has its own set of financial reporting standards called Thai Financial Reporting Standards (TFRSs), which are based on the International Financial Reporting Standards (IFRSs) to ensure international acceptance. These financial reporting standards apply to legal entities responsible […]

Bookkeeping Services

What is Bookkeeping ?? Bookkeeping is the process of recording various financial transactions of a company, whether it is the receipt or payment of money, in order to prepare financial reports for the company. Bookkeeping is essential for any business, regardless of its size or industry, as it involves accurately recording financial transactions, including expenses, […]