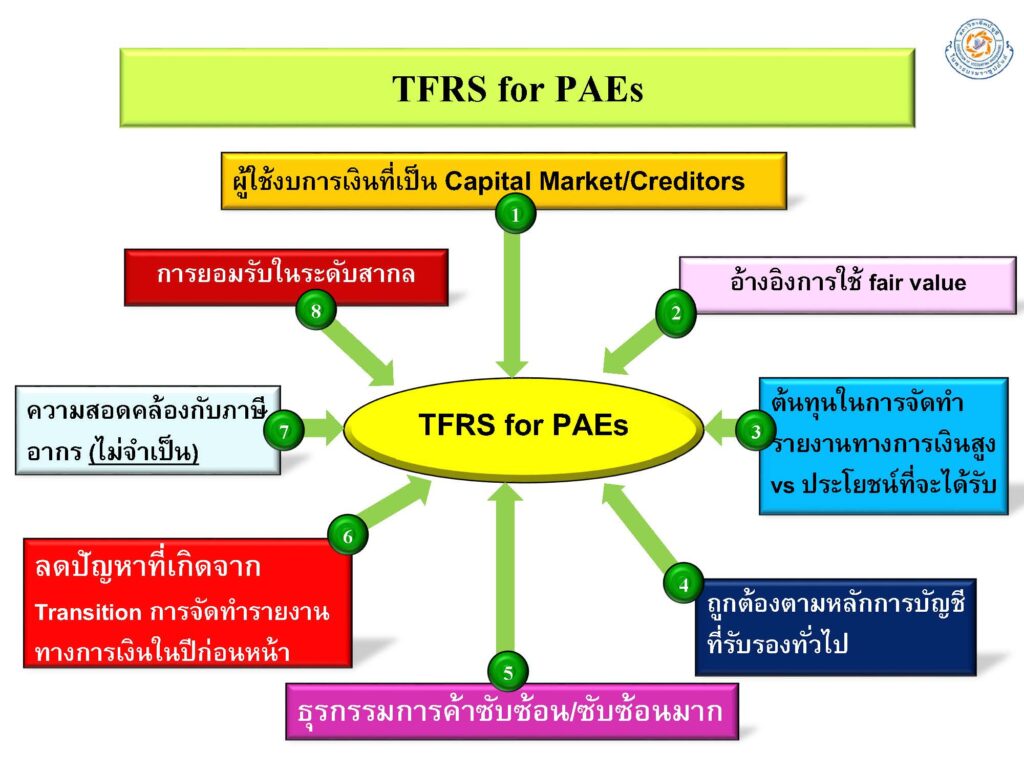

Before we delve into PAEs and NPAEs, let’s get acquainted with the financial reporting standards in Thailand. Thailand has its own set of financial reporting standards called Thai Financial Reporting Standards (TFRSs), which are based on the International Financial Reporting Standards (IFRSs) to ensure international acceptance. These financial reporting standards apply to legal entities responsible for accounting in accordance with the Accounting Act of 2000. This includes registered companies trading in the stock market as well as general entities outside the stock market. However, while the international financial reporting standards are intended for publicly accountable entities (PAEs) and involve complex requirements, such as the use of fair value as a basis for financial reporting, they impose additional costs on the financial reporting process for non-publicly accountable entities (NPAEs). NPAEs primarily consist of medium-sized and small-scale businesses.

Publicly Accountable Entities | PAEs

Publicly Accountable Entities (PAEs) refer to businesses that fall into the following categories :

- Businesses with equity or debt securities traded in the public market.

- Businesses that submit or are in the process of submitting financial statements to the Securities and Exchange Commission (SEC) or regulatory bodies for the purpose of issuing securities in the public market. This includes businesses engaged in primary financial activities and the management of assets owned by a wide range of external individuals or entities, such as financial institutions, life insurance companies, non-life insurance companies, mutual fund management companies, and commodity futures exchanges in Thailand.

- Public companies.

- Other entities as determined and specified, which are required to prepare financial statements using the comprehensive set of accounting standards (TFRS (2009)). This set includes accounting standards such as TAS 32 (TFRS 4), TIC 4, and TFRIC 1.

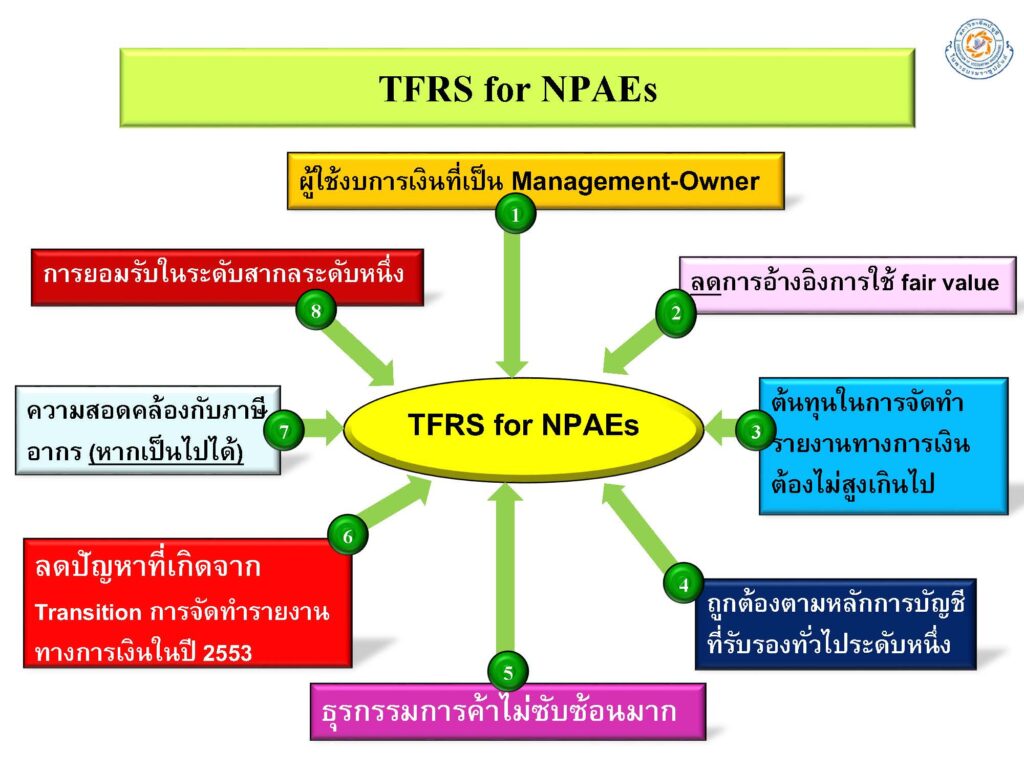

Non-Publicly Accountable Entities | NPAEs

Non-Publicly Accountable Entities (NPAEs) refer to entities that are not PAEs and may prepare financial statements using either the small set of accounting standards (TFRS for NPAEs (2011)) or the comprehensive set of accounting standards if they do not wish to adopt the TFRS for NPAEs.

The difference between TFRS for PAEs and NPAEs standards.

PAEs | NPAEs | |

Financial Statements | – Comprehensive Income Statement | – Profit and Loss Statement (P&L) |

– Cash Flow Statement | – statement of comprehensive income (non-disclosure of specific expenses). | |

– statement of financial position (3-period balance sheet) | ||

–income statement (mandatory disclosure of significant expenses and additional disclosure of expenses by nature). | ||

Investment capital | – cost of sales | – cost deducted by provision for depreciation |

–fair value (trading/securities held for sale). | – fair value adjustments through profit or loss and other comprehensive income. | |

Investment in subsidiaries. | – Financial statements must be prepared and recognition of profit/loss must be in accordance with the revenue and expense recognition principles. | –No need to prepare consolidated financial statements and record cost prices. |

Employee benefits. | – Calculation must be based on actuarial mathematics standards. | – Calculate using an estimation method, which the Auditor deems reasonable. |

Intangible Assets | – No need for disposal (similar to depreciation calculation), by examining whether there is impairment at the end of the year or not. | – Disposal after 10 years. |

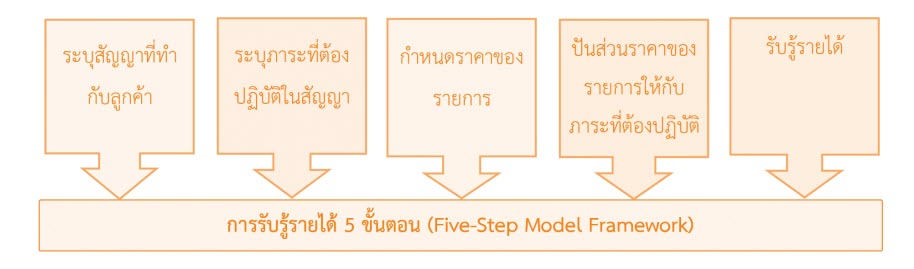

Recognize revenue. | – According to TFRS 15’s 5-step process. | – Recognize revenue when control is transferred or at a point where risks and rewards are transferred and revenue is recognized. |

Income from real estate sales | – Revenue is recognized upon transfer. | – Can choose 3 Options |

1. Receiving income upon transfer | ||

2. Understanding income based on the proportion of successfully completed work | ||

3. Understanding income based on installment payments transferred when due | ||

Income TAX | –Calculating deferred tax assets due to differences between accounting and tax, which may result in assets/liabilities, income tax, or deferred tax assets (DTA)/deferred tax liabilities (DTL). | – No need to calculate, just record the accrued Income TAX. |

According to TFRS 15's 5-step process.