Currently, businesses in our country are providing opportunities for entrepreneurs to expand their markets to foreign countries. This is another avenue for increasing sales and promoting business growth. However, in conducting international business, it is essential for entrepreneurs to understand the conditions of delivery, as it directly impacts the cost of their business. Regarding the conditions of delivery, known as Incoterms (International Commercial Terms), they are internationally recognized standard terms used to define the responsibilities, costs, and risks between buyers and sellers in a sales contract. These terms aim to ensure mutual understanding between both parties.

The Origins of INCOTERM

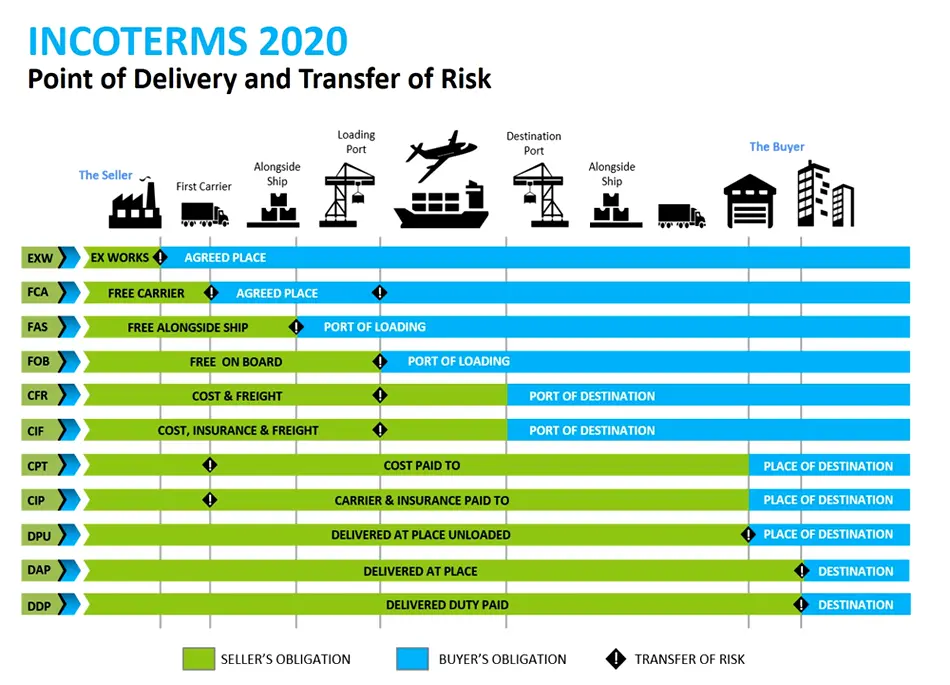

The International Chamber of Commerce (ICC) convenes its members every 10 years to establish guidelines for international delivery of goods, known as International Commercial Terms (INCOTERMS). These terms were first introduced in 1936 and have since undergone several revisions to align with evolving trade practices, technological advancements in electronic communication, and changes in logistics and supply chain systems. The scope of INCOTERMS is limited to issues related to the rights and obligations of the buyer and seller in terms of the delivery of sold goods. It consists of 11 agreed-upon terms, including :

- EXW (Ex Works)

- FCA (Free Carrier)

- FAS (Free Alongside Ship)

- FOB (Free on Board)

- CFR (Cost and Freight)

- CIF (Cost Insurance and Freight)

- CPT (Carriage Paid to)

- CIP (Carriage Insurance Paid to)

- DAT (Delivered at Terminal)

- DAP (Delivered at Place)

- DDP (Delivered Duty Paid)

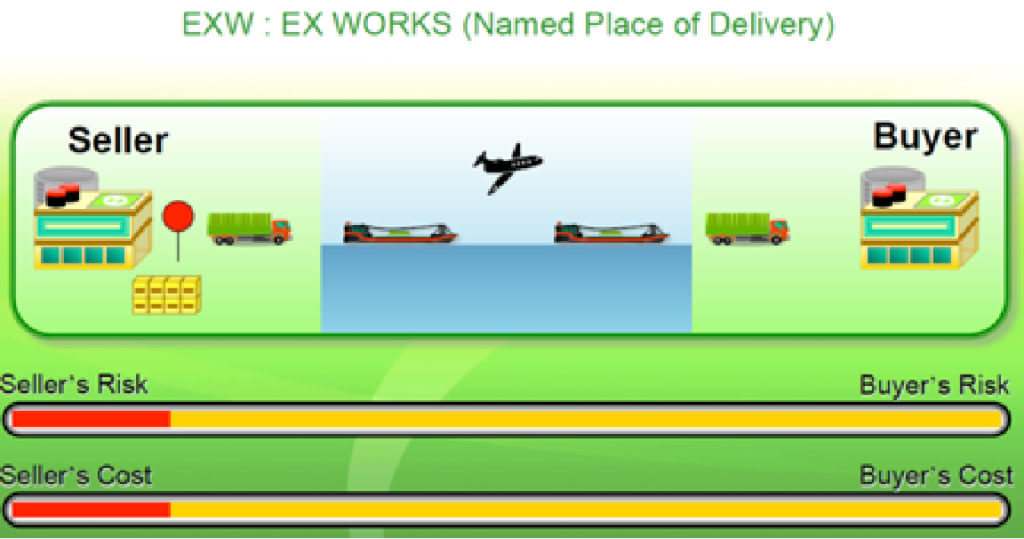

EXW - (Ex Works)

The seller delivers the goods to the buyer at the seller’s premises, such as a factory or a warehouse. The buyer assumes the responsibility for handling operations, expenses, and any risks after the goods have been delivered. This includes transportation of the goods, customs procedures for export, and so on.

The responsibilities of the seller.

The seller is responsible for preparing the goods, commercial invoice, and any other documents specified in the contract. The seller is not responsible for transporting the goods to the buyer, conducting export procedures, entering into transportation or insurance contracts. The seller must bear all expenses related to packaging, inspection activities (such as quality inspection, measurement, weighing, counting), and assume the risk of loss or damage to the goods until they are delivered. The seller must provide assistance, arrange for documents, and provide necessary information as requested by the buyer for export purposes, such as safety inspection permits or other officially authorized powers required for export, import, and/or transportation of the goods to the final destination, at the buyer’s risk and expense.

The responsibilities of the buyer.

- The buyer assumes all risks of loss or damage to the goods from the time they have been delivered or on the agreed-upon date, or the end of the delivery period.

- The buyer must pay the price of the goods as specified in the sales contract, bear the cost of obtaining export and import licenses or any delegated powers, as well as any expenses for inspections as required to be conducted before export. The buyer is responsible for complying with export procedures, paying customs duties, and all other charges.

FCA – Free Carrier

In the case of this type of shipment, the seller is responsible for the transportation costs to the airport or customs, in order to prepare for export by air or sea. Once the goods are on board the transporting vehicle, the costs related to freight and others will become the responsibility of the buyer. Therefore, the price includes the shipping costs by air or sea.

FAS – Free Along Side

The seller is not responsible for any costs incurred from the origin to the port, transport, or airport. Therefore, the seller’s responsibility for the goods ends at the point where they are placed on board the ship at the port of shipment. Only the origin is the seller’s responsibility. After that, the buyer is responsible for all costs and risks.

FOB – Free Onboard Vessel

The seller has the responsibility to deliver the goods on board the vessel at the designated port of shipment. The buyer, on the other hand, is responsible for all costs and risks, including any loss or damage that may occur once the goods are on the vessel. This agreement applies to transportation by sea or inland waterways only.

The responsibilities of the seller.

The seller is responsible for preparing the goods, commercial invoice, and any other documents specified in the contract. The seller must deliver the goods by placing them on board the vessel at the agreed-upon port of shipment, on the specified date or within the agreed-upon timeframe. The seller must bear the expenses related to inspections (such as quality inspections, measurements, weighing, and counting) conducted by the authorized authorities of the exporting country. The seller is also responsible for packaging the goods, covering the costs of export procedures, including customs duties and any other charges payable upon export. Additionally, the seller assumes all risks of loss or damage to the goods until they have been delivered. However, the seller is not obligated to arrange transportation or insurance contracts.

The responsibilities of the buyer.

CFR – Cost and Freight

The seller shall be responsible for transportation costs, destination customs duties, and assume the risks associated with the goods until they reach the vessel or aircraft. However, if any risks occur during the carriage by the aircraft or vessel, the seller will not be held liable.

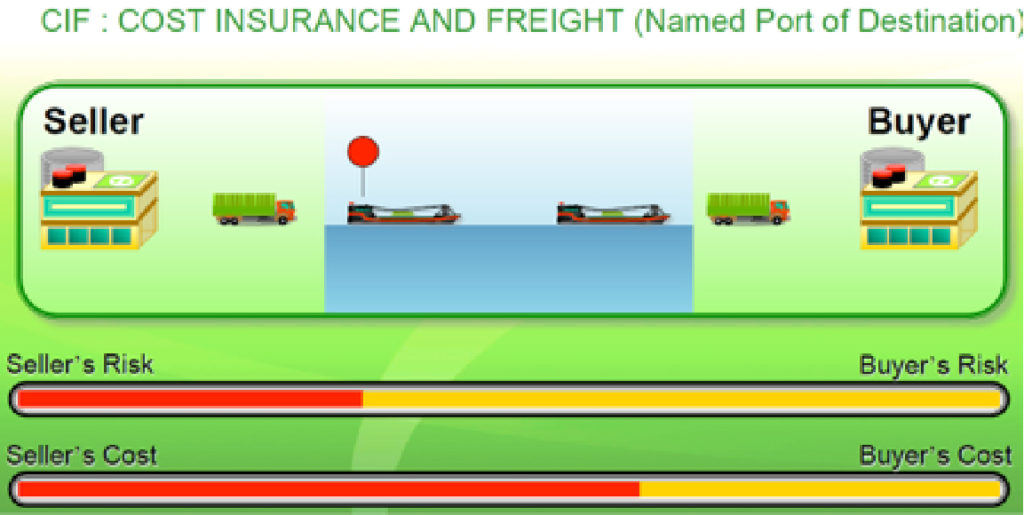

CIF – Cost, Insurance & Freight

The seller shall bear the same responsibilities as CFR (Cost and Freight) and shall be liable for insurance coverage against the risk of loss or damage during transportation until the final destination. The seller is responsible for arranging and paying for the insurance. This agreement applies to transportation by sea or inland waterways only.

The responsibilities of the seller.

The seller shall prepare the goods, commercial invoice, and any other documents as specified in the contract. The seller shall package the goods at their own expense and obtain the necessary export permits or provide other official authorizations for export. The seller shall bear the costs associated with inspection activities (such as quality inspection, measurement, weighing, and counting) for the delivery of goods, as well as any inspection costs required prior to shipment, as determined by the authorized agencies of the exporting country. Additionally, the seller shall arrange or obtain contracts for the transportation of goods, insurance coverage, and assume all risks of loss or damage to the goods until they are delivered. The seller shall also bear the costs of weighing and any other expenses incurred at the delivery location to the specified destination port. The seller is responsible for paying insurance premiums, export clearance costs, customs duties, and any other charges required for export.

The responsibilities of the buyer.

The buyer shall pay the price of the goods as specified in the sales contract. The buyer shall also bear the costs of any inspections required prior to shipment, obtain import permits or provide other official authorizations, and carry out the necessary import procedures at their own risk and expense. Furthermore, the buyer assumes all risks of loss or damage to the goods from the time of delivery, and the buyer shall pay all expenses related to the goods from the time of delivery. This includes transportation costs, unloading costs from the vessel, shipping and handling charges, port charges, customs duties, and any other charges.

CPT – Carriage Paid To

The seller shall be responsible for expenses until the goods are delivered to the carrier at the destination. These expenses include transportation costs and cargo insurance, which shall cease upon delivery of the goods to the carrier.

DDU – Delivery Duty Unpaid

This term provides a comprehensive definition of delivery when the goods are unloaded from the truck or placed at the specified destination, such as storing the goods at the buyer’s warehouse, delivering them to the buyer’s residence, or placing them at the buyer’s workplace.

DAP – Delivered At Place

In this term, the seller will be responsible for everything, except for import taxes in each destination country and insurance costs in the event of unforeseen circumstances. These will be the buyer’s responsibility.

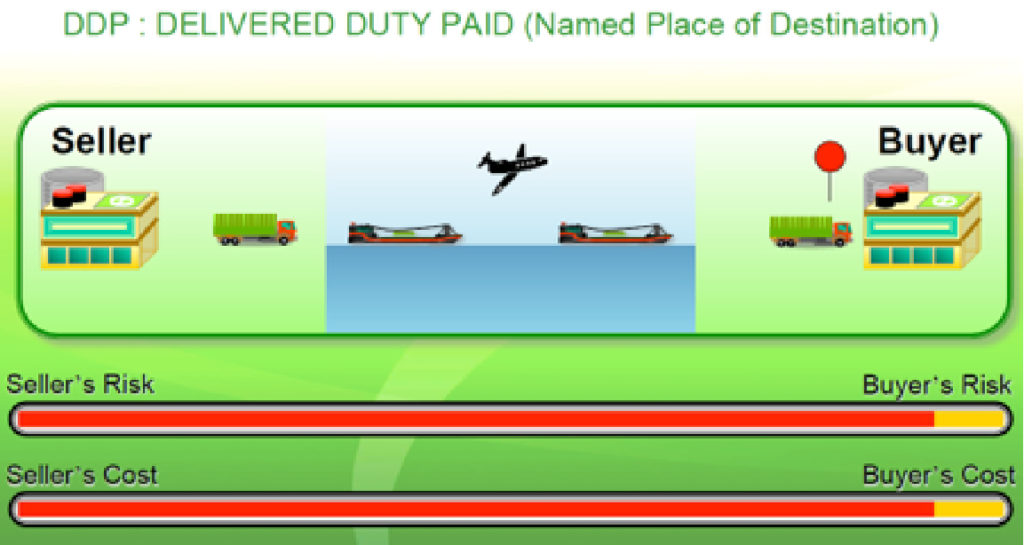

DDP – Delivered Duty Paid

The seller is responsible for delivering the goods at the location specified by the buyer within the jurisdiction. The seller assumes all risks and expenses associated with transporting the goods to the final destination. The seller handles the export and import procedures, including the payment of customs duties and other related fees, until the goods reach the destination. This agreement may apply in cases where there are multiple forms of transportation.

The responsibilities of the seller.

- The seller is responsible for preparing the goods, invoices, and any other documents specified in the contract. The seller must enter into a transportation contract for delivering the goods to the designated destination, either at the agreed-upon destination or at the point of arrival, at their own expense. The seller must deliver the goods on the transport vehicle that has arrived and is ready for transportation at the designated destination on the agreed-upon date or within the agreed-upon timeframe. The seller must also provide insurance coverage at their own expense.

- The seller is required to bear the expenses associated with inspection activities such as quality inspection, measurement, weighing, and counting, as specified by the authorized agencies of the exporting and importing countries. The seller must package the goods and pay the costs associated with export and import procedures, including customs duties, taxes, and any other charges applicable to exports and imports. Additionally, the seller assumes all risks of loss or damage to the goods until the goods are delivered.

The responsibilities of the buyer.

- The buyer is required to pay the price of the goods as specified in the sales contract and assumes all risks of loss or damage to the goods from the time of delivery. The buyer must also bear all expenses related to the goods from the time of delivery. This includes any additional costs associated with the transportation of the goods for taking delivery from the arriving transport vehicle at the designated destination.

- The buyer is responsible for taking delivery of the goods once they have been delivered. The buyer is not obligated to enter into contracts for transportation or insurance.

- The buyer is not responsible for paying the expenses related to inspections, which are designated to be carried out by the authorized agencies of the exporting and importing countries.

FOB Import Accounting Records

In the case where a business imports goods from abroad using F.O.B. Shipping Point terms, ownership of the goods will belong to the buyer once the seller delivers the goods to the buyer’s hands. This will be determined based on the date stated in the Bill of Lading, which records the goods according to the itemized list.

Debit: Goods in Transit xxxx

Credit: Trade Payables xxxx

After the business has received the goods successfully, the following entry will be recorded.

Debit: Purchases xxxx

Credit: Goods in Transit xxxx