Value Added Tax (VAT)

Value Added Tax, or VAT, is a type of tax imposed by the revenue department, collected from the sale of goods or provision of services at each stage of production and distribution of goods/services, including those produced domestically and imported from abroad (according to the revenue code, the standard rate is 10%, excluding local taxes). However, there has been a temporary reduction to 6.3% for the VAT rate and 0.7% for local taxes, resulting in the current rate of 7% collected. On August 24, 2021, a resolution was passed to extend the reduced VAT rate of 7% for an additional 2 years, starting from October 1, 2021, until September 30, 2023.

VAT 0

VAT 0 means that the business generates income but does not collect Value Added Tax (VAT = 0). However, the business still has the obligation to file a tax return form (P.P.30) showing the details of purchase and sales taxes according to Section 80/1. The tax rate of 0% should be used for calculating Value Added Tax for various types of businesses as follows:

(1) Exporting goods that are not exempted from Value Added Tax according to Section 81(3).

(Refer to the directive of the Revenue Department, number P.D.97/2543)

(2) Providing services performed within the Kingdom and having the utilization of such services abroad, according to the main types, criteria, methods, and conditions specified by the Director-General.

The provision of services performed within the Kingdom, with the utilization of such services abroad, includes services performed within the Kingdom for the production of goods in the industrial free zone for exportation, and services performed in the export processing zone for the production of goods for exportation.

(Refer to the amended Revenue Code (Version 35), BE 2544)

(Refer to the directive of the Revenue Department, number P.D.104/2544)

(3) International transportation services by air or sea performed by corporate entities.

(Amended and supplemented by the Revenue Code Amendment Act (Version 33), effective from 1st January 2542 onwards)

(4) Sales of goods or provision of services to ministries, departments, local government agencies, or state enterprises under foreign loan projects or assistance programs, subject to criteria, methods, and conditions prescribed and approved by the Cabinet.

“(5) Sales of goods or provision of services to: (a) United Nations organizations, specialized agencies of the United Nations, embassies, consulates, consular offices, and diplomatic missions. (b) International organizations with which Thailand has bilateral agreements to provide equal treatment to embassies, consulates, consular offices, and specialized agencies of the United Nations. (c) Foreign economic and trade offices established in Thailand pursuant to agreements between the Thai government and foreign governments. Note: This applies only to sales of goods or provision of services in accordance with the criteria, methods, and conditions prescribed by the Director-General.

(Amended and supplemented by the Revenue Code Amendment Act (Version 49), effective from 28th February 2562 onwards)

“(6) Sales of goods or provision of services between bonded warehouses or between operators located within the same or different customs-free zones, or between bonded warehouses and operators located within customs-free zones. Note: This applies only to sales of goods or provision of services in accordance with the criteria, methods, and conditions prescribed by the Director-General.

(Refer to the Revenue Code Amendment Act (Version 35), BE 2544)

The term ‘bonded warehouse’ in this context refers to a bonded warehouse as defined by customs law.

Exemption from Value Added Tax (Non-VAT)

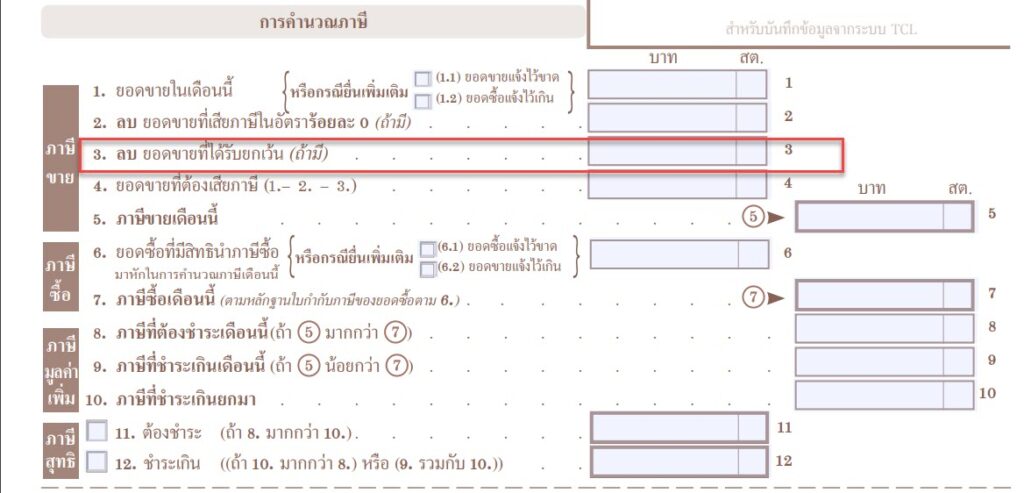

Exemption from Value Added Tax (Non-VAT) means that the business operator is not required to calculate tax based on their income. However, they must include the income in the calculation for Form P.P.30, Section 3.

Specific types of businesses are eligible for Value Added Tax (VAT) exemption according to Section 81. The following types of businesses are exempted from VAT for the sale of goods or provision of services:

(1) Sale of agricultural produce, including stems, branches, leaves, peels, shoots, roots, bulbs, flowers, fruits, seeds, or other parts of plants and floating materials derived from plants, provided they are fresh, preserved to prevent temporary damage during transportation (e.g., refrigeration), preserved by other methods, or preserved for retail or wholesale purposes through cooling, freezing, drying, grinding, or other methods. This includes rice or rice products obtained from rice milling, but does not include timber, rattan, or wood products obtained from wood sawing or industrial food products packaged in cans, containers, or wrappers as defined by the Director-General based on their nature and conditions.”

Please note that this translation is based on the provided text and may not capture the full legal context or implications. It’s always recommended to consult the original legal documents or seek professional advice for accurate information.

(Refer to the Ruling of the Tax Appeal Commission No. 32/2538)

(Refer to the Order of the Revenue Department No. 28/2535)

(ข) Selling animals, whether living or not. and in the case of inanimate animals Whether it is meat, various parts of animals, eggs, milk and animal by-products, provided that they are in fresh condition. or temporarily preserve the condition so as not to spoil during transport by refrigeration Refrigerate until solid. or by preparing or modifying it by other means or maintain the condition so that it does not spoil for retail sale or wholesale by refrigerated method Freeze, freeze, dry, grind, shred or otherwise. But this does not include food products that come in cans, containers, or industrial packages according to the characteristics and conditions specified by the Director-General.

(See Revenue Department order No. P.29/2535)

(See the announcement of the Director-General of the Revenue Department About Value Added Tax (No. 3)

(ค) Fertilizer sales

(ง) Sale of fish meal, animal feed

(จ) Selling drugs or chemicals used for plants or animals. To maintain, prevent, destroy or eliminate enemies or diseases of plants and animals.

(ฉ) Selling newspapers, magazines, or textbooks.

(See the decision of the Tax Commission No. 32/1995)

(ช) Educational services provided by government educational institutions. Educational institutions according to the law on Private higher education institutions or a private school according to the law on private schools

(ซ) Providing services that are artistic and cultural works in the field and the nature of business operations as determined by the Director-General with the approval of the Minister.

(See the announcement of the Director-General of the Revenue Department About Value Added Tax (No. 11))

(ฌ) Providing services in the practice of medicine, auditing, adjudication, or other independent professions as determined by the Director-General. With the approval of the minister, this applies only to independent professions that are controlled by law. Independent professional practice

(ญ) Providing medical care services of medical facilities in accordance with the law on medical facilities.

(ฎ) Providing research services or providing academic services in the field and nature of business determined by the Director-General with the approval of the Minister.

(See the announcement of the Director-General of the Revenue Department About Value Added Tax (No. 12))

(See the announcement of the Director-General of the Revenue Department About Value Added Tax (No. 238))

(ฏ) Providing services of libraries, museums, zoos

(ฐ) Providing services according to labor contracts

(ฑ) Providing services for organizing amateur sports competitions

(ฒ) Providing services by public actors, provided only services in the fields and nature of business operations as determined by the Director-General with the approval of the Minister.

(See the Revenue Department Order No. P.120/2002)

(See the announcement of the Director-General of the Revenue Department About Value Added Tax (No. 13))

(ณ) Providing transportation services in the Kingdom

(See Royal Decree (No. 241) B.E. 2534)

(ด) Providing international transportation services which is not transported by aircraft or sea-going ship.

(See Revenue Department Order No. P.49/2537)

(ต) Providing real estate rental services.

(See Revenue Department Order No. P.90/1999)

(See Revenue Department order No. P.107/2001)

(ถ) Providing services of local government, but this does not include commercial services of local government. Or is it to earn income or benefits whether it is public utility business or not

(ท) Sales of goods or provision of services by ministries, bureaus, and departments which send all revenue to the state without deducting expenses.

(ธ) Selling goods or providing services for the benefit of religion. or public charity within the country which does not use the profits to be paid in other ways

(น) Sale of goods or provision of services as prescribed by the Royal Decree.

( ดูพระราชกฤษฎีกาฯ (ฉบับที่ 239) พ.ศ.2534 )

( ดูพระราชกฤษฎีกาฯ (ฉบับที่ 321) พ.ศ.2541 )

( ดูพระราชกฤษฎีกาฯ (ฉบับที่ 327) พ.ศ.2541 )

( ดูพระราชกฤษฎีกาฯ (ฉบับที่ 333) พ.ศ.2541 )

( ดูพระราชกฤษฎีกาฯ (ฉบับที่ 336) พ.ศ.2541 )

( ดูพระราชกฤษฎีกาฯ (ฉบับที่ 343) พ.ศ.2541 )

( ดูพระราชกฤษฎีกาฯ (ฉบับที่ 347) พ.ศ.2542 )

( ดูพระราชกฤษฎีกาฯ (ฉบับที่ 370) พ.ศ.2543 )

( ดูพระราชกฤษฎีกาฯ (ฉบับที่ 401) พ.ศ.2545 )

( ดูพระราชกฤษฎีกาฯ (ฉบับที่ 403) พ.ศ.2545 )

( ดูพระราชกฤษฎีกาฯ (ฉบับที่ 404) พ.ศ.2545 )

( ดูพระราชกฤษฎีกาฯ (ฉบับที่ 408) พ.ศ.2545 )

( ดูพระราชกฤษฎีกาฯ (ฉบับที่ 448) พ.ศ.2549 )

( ดูพระราชกฤษฎีกาฯ (ฉบับที่ 486) พ.ศ.2552 )

( ดูพระราชกฤษฎีกาฯ (ฉบับที่ 489) พ.ศ.2552 )

( ดูพระราชกฤษฎีกาฯ (ฉบับที่ 510) พ.ศ.2554 )

( ดูพระราชกฤษฎีกาฯ (ฉบับที่ 546) พ.ศ.2555 )

( ดูพระราชกฤษฎีกาฯ (ฉบับที่ 585) พ.ศ.2558 )

( ดูพระราชกฤษฎีกาฯ (ฉบับที่ 608) พ.ศ.2559 )

( ดูพระราชกฤษฎีกาฯ (ฉบับที่ 662) พ.ศ.2561 )

( ดูพระราชกฤษฎีกาฯ (ฉบับที่ 759) พ.ศ.2565 )

(2) Importing the following products:

(a) Products according to (1) (a) to (f).

”(B) Goods from foreign countries imported into the duty free zone, but only those goods which are exempt from import duties in accordance with the law on that matter.”

( Act amending the Revenue Code (No. 35) B.E. 2001 )

(c) Goods classified in the section on goods exempt from duties. According to the law on customs tariffs

(d) Goods which are imported and are in the custody of customs. and then sent back abroad The import duty was refunded. According to the customs law

(3) Exports of goods or services by registered operators which are subject to value added tax under Section 82/16.

Exemption from Value Added Tax for business operations under this section. The Director-General will propose to the Tax Adjudication Committee to determine the nature of the business. and conditions for operating businesses that are exempt under this section. and when the Tax Adjudication Committee has made a decision The decision of the said committee shall be published in the Royal Gazette. and if the business is not in accordance with the characteristics and conditions specifying that business will not be exempt from Value Added Tax under this section.

VAT 0 vs Non VAT

VAT 0 | Non VAT |

Entrepreneurs must register for VAT. | No need to register VAT and no need to submit P.P.30 form. |

Can request a refund of purchase tax | Not eligible to use purchase tax |

Must issue a tax invoice | Only a receipt is issued. |