Filing financial statements for the year 2023 and submitting corporate tax returns for the year 2023 for business owners

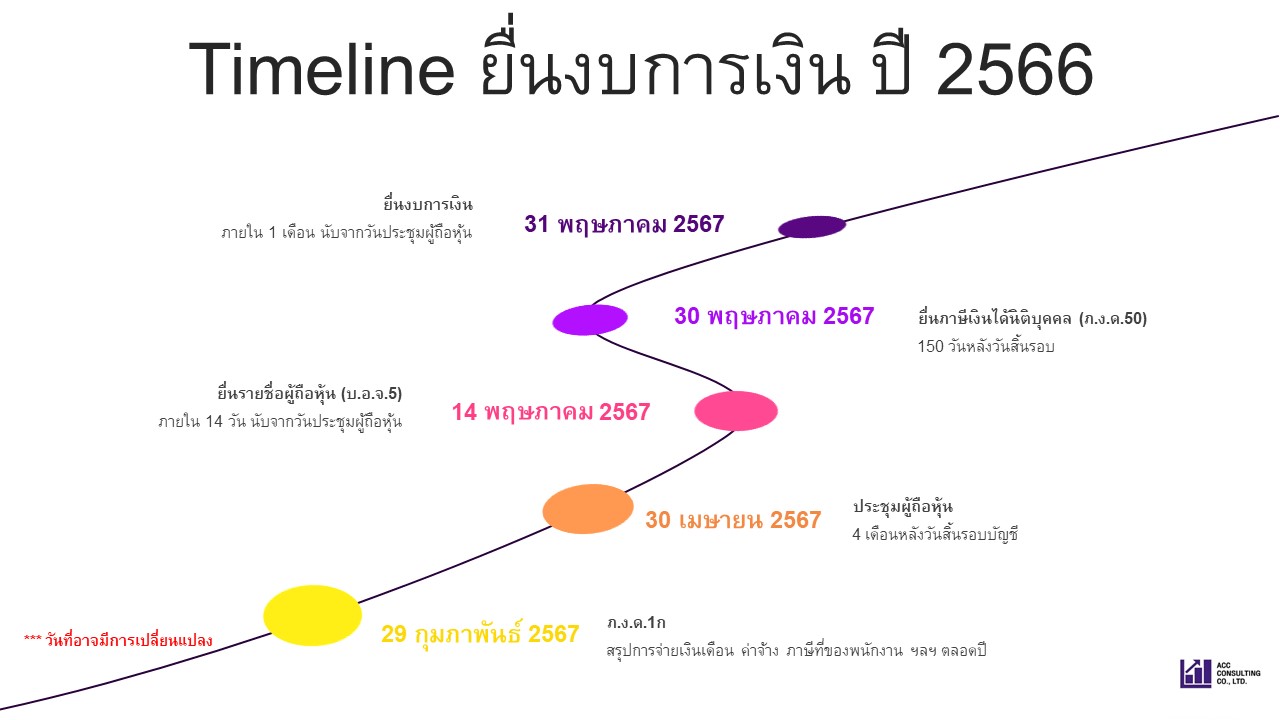

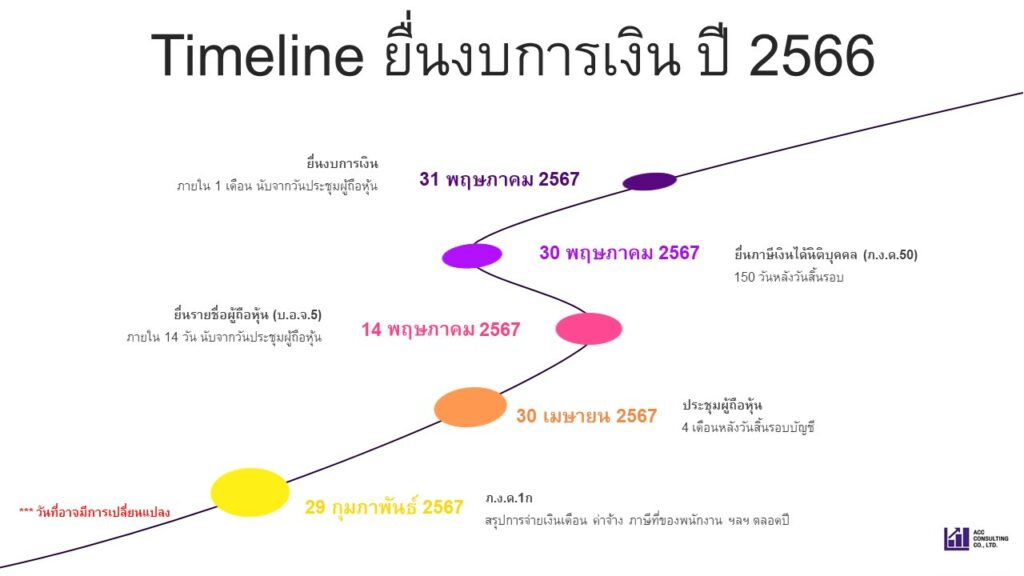

For business owners of a limited company with a fiscal year-end on December 31, 2023, the following deadlines apply for closing the financial statements for the year 2023, auditing the financial statements for the year 2023, filing the financial statements for the year 2023, and submitting the corporate tax returns for the year 2023, all within the respective deadlines as follows :

- Submit Form PND.1K (Summary of Salary, Wages, and Withheld Taxes of Employees, etc., throughout the year) by February 29, 2024.

- Hold a Shareholders Meeting by April 30, 2024(within 4 months after the fiscal year-end).

- Submit the list of shareholders (Form BOR.5) by May 14, 2024(within 14 days after the Shareholders Meeting).

- File the corporate income tax return (Form PND.50) by May 30, 2024(150 days after the fiscal year-end).

- Submit the financial statements by May 31, 2024(within 1 month from the Shareholders Meeting).